How to save on interest on your loans

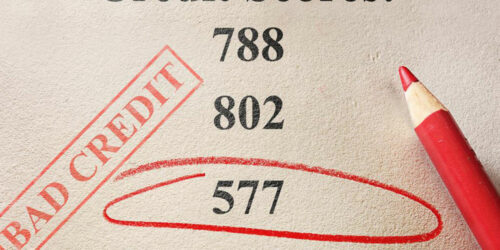

It is easy to get loans today, but not easy to get low-interest loans. Today banks charge a huge amount of money in the form of interest, which will give you cold feet even before you meet the bank manager to approve your loan. The truth is that lower your interest rate, the easier it gets to pay off your loan.

Read More